When searching for your first or next home, it’s natural to have several questions. Among them, the most pressing may be whether you’ll qualify in the current rate environment, and how the upcoming changes in 2023 could affect your affordability. Bruno recognizes the importance of feeling confident in your purchasing power and understands the challenges of navigating the ever-changing real estate market. With this in mind, he offers a simple pre-approval process that can provide you with the peace of mind you need to make informed decisions and be ready for market opportunities.

Renewing your mortgage can often be a daunting task and time out of your busy day, but it doesn’t have to be that way. The overwhelming questions you may be asking yourself, such as “Am I getting the best offer from my bank?” and “Should I choose a fixed or variable rate?” are completely understandable. However, with Bruno’s extensive access to multiple lenders, he can offer you a wider selection of choices and rates. Rest assured, he’ll help guide you through the process and ensure you get the best possible offer and usually ZERO cost to you.

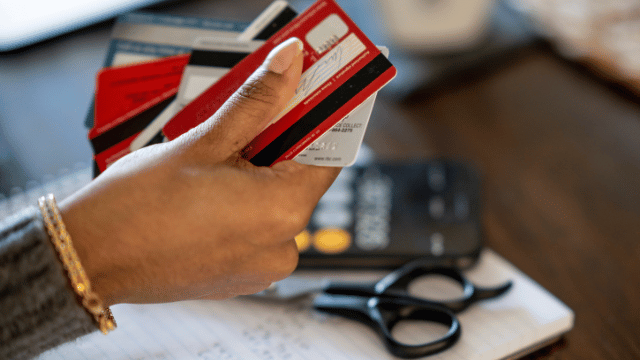

Accessing existing equity to pay off high-interest credit card debt can be a crucial step towards improving your cashflow and increasing your savings, particularly in today’s economic climate. It can also help with improving your credit profile for when your mortgage renewal comes up. There has never been a more critical time to take action and seek out these funds to help alleviate the burden of high-cost debt and secure a better financial future. Bruno offers a fast, stress-free refinance process to help you reach your financial goals today.